Buying a mobile home with low credit score

Tips to keep your family and home safe during hurricane season. Activate by mobile app for free.

Manufactured Home Loans Mobile Home Loans In 2022 Mobile Home Loans Home Loans Home Buying

If youre buying a mobile home from a private owner its also possible to work out a financing deal with them.

. You also may have to pay a home inspection fee. Home Repair Emergency Fund. Our guides and calculators make it simpler for our veterans to buy the home of their dreams.

It is acceptable in most countries and thus making it the most effective payment method. Generally speaking a credit score of 720 or higher will get you a good interest rate on a conventional loan but qualification criteria depends on the specific lender. However remember that mobile home sellers want to make a deal.

Tailored to borrowers with lower credit FHA makes it possible to buy a house with a credit score of just 580 and only 35 down. Were experts at finding excellent quality low-mileage specialty vehicles including firetrucks busses ambulances police cruisers and more. There may also be niche loans available for people with low credit scores and income in some cases when buying a new.

View your FICO Score through your OpenSky account an easy way to stay on top of your credit. Now you can get a rate as low as 399 APR when you get a loan for an RV camper or boat. Who make on-time payments improve their FICO score 30 points in the first 3 months.

Buying a Second Home. To make matters more complicated for the millions of Americans who have a not-so-great credit score credit can be a major source of worry when applying for loans. Your credit score down payment amount and type of home and whether youre buying the land will affect the amount you pay.

Your credit score can either be a major green or red flag to a prospective landlordHowever if you have poor credit or no credit history at all you might experience some difficulty getting your application approved. Mobile home prices for new ones range from 40000 to 250000. Rare unique specialty vehicles for sale.

The as low as 670 credit score requirement makes the card more accessible. What You Need for Moving Day. Youll likely need a down payment.

Automotive Specialties offers a unique inventory of rare and hard-to-find vehicles for sale. Theres no exact credit score that determines whether or not youre allowed to rent an apartmentBut that doesnt mean credit isnt important. Repairs to Mobile or Manufactured.

Most banks will require at least 10 percent down payment or 1000 whichever is. The impact of a slight credit score drop is near meaningless. For FHA loans you can usually get approved with a credit score of 580 or higher.

When it comes to buying a home a bad credit. For used mobile homes the prices range from 10000 to 50000. This buying a mobile home checklist 2021 should prove enlightening because the process between manufactured and site-built structures is quite different.

Lenders may require a home inspection fee to confirm that your house is livable and structurally sound. All About Mortgages With Zero or Low Down Payments Feb 01 2017. PayPal is one of the most widely used money transfer method in the world.

Home Mortgage. A good credit score ranges from 700 to 749 according to the FICO credit range while on a Vantage Score 30 you would end up at a B grade. Renting vs buying a home.

VA USDA Rural Chattel HUD or other conventional options. We also accept payment through. Yes we offer DreaMaker Federal Housing Administration FHA and Veterans Affairs VA loans that offer low down payment options with flexible credit score requirements.

Latest-news Thailands most updated English news website thai news thailand news Bangkok thailand aecnewspaper english breaking news. Credit scores for FHA loans can go as low as 500 if you can pay a 10 down. The Rural Repair and Rehabilitation Loan and Grant Program also known as the Section 504 loan and grant fund is a USDA program that can help with mobile home repairs and upgrades if the following restrictions are met verbatim from this form.

We accept payment from your credit or debit cards. Plus our mobile banking app and digital services make it uber-convenient and easy for you to manage your money 24. In addition you may qualify for a 2500 or 5000 Chase Homebuyer Grant andor 500 Homebuyer Education Benefit DreaMaker only that can be used to lower your closing costs.

For those looking at their score and wondering what is a good credit score its helpful to understand that each of the credit reference agencies has a different scoring range. The higher your credit score the lower the interest rate youll receive. But home buyers arent the only ones who can benefit.

Typically requires a 620 credit score but will consider applicants with a 580 credit score as long as other eligibility criteria are met Minimum down payment 35 if moving forward with an FHA loan. Let us know what youre looking for and our pros can find it for you or see how much you could get when you. Section 504 The Rural Repair and Rehabilitation Loan and Grant Program.

Florida gas prices dip to five month low In Miami on Monday the average was 389 a gallon Fort Lauderdales average was 386. If youre trying. Available in all 50 states Manufactured Nationwide offers mobile home loans with low credit score and down payment requirements and flexible loan terms.

A high score sends all the right signals while a low credit score sometimes referred to as bad credit can keep you from getting approved. To qualify for low mobile home interest rates make sure your credit. Here is a hard truth about buying a car with relatively new or bad credit.

Apply in less than 5 minutes right from your mobile device. Home buying is a slightly different experience for veterans. If you get approved for a mortgage to help pay for the cost of a.

You can check your credit score for free with Credit Sesame to see whether you fall inside the good credit range. The process of shopping for a used mobile home can be exhausting and even a little bit intimidating. Pros Cons Pros.

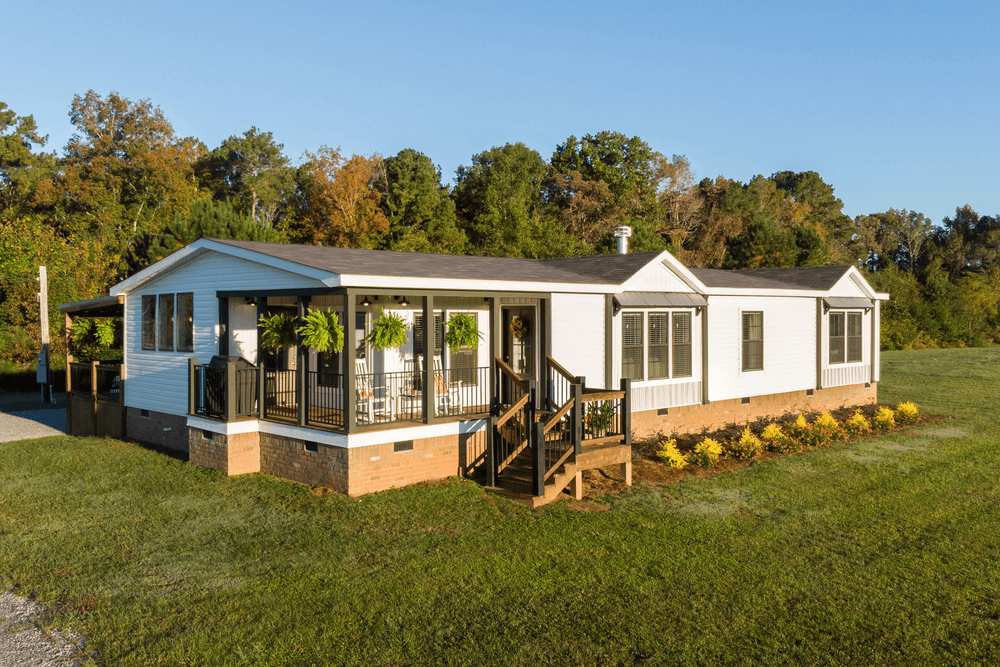

What credit score is needed to buy a house. The actual cost of new and secondhand mobile homes. Lets get to the most important bit of mobile home pricing first.

When you rent a home or apartment your credit is affected in a number of ways. Appraisal fees will vary depending on where you live and the size of your home but you can expect to pay anywhere between 300 and 1000. These are as follows.

Mobile home prices and the factors involved.

Pros Cons For Buying Renting Lease To Buy Real Estate Real Estate Buying Rent Prices Credit Score

Ultimate Guide To Manufactured Homes Forbes Advisor

How To Buy A Home With Bad Credit And No Money For Most People Who Suffer From Poor Credit Scores No Credit Sco Loans For Bad Credit Credit Repair Bad Credit

What Kind Of Credit Score Do You Need To Buy A Mobile Home American Homestar

Manufactured Homes Offer Relief As Affordability Squeeze Tightens Bankrate

Pin By Mobile Home Living On Mobile Home Living Remodeling Mobile Homes Manufactured Home Remodel Mobile Home Kitchen

Used Mobile Homes Finder Pre Owned Land Home Repos In Texas

Mobile Home Loans What You Should Know Rocket Mortgage

Usda Home Loans Home Loans First Time Home Buyers Usda Loan

Buy Your First House With No Money Down Home Buying Real Estate First Time Home Buyers

Fha Manufactured And Mobile Home Guidelines Fha Lenders

Mobile Home Living Manufactured Home Mobile Home Living Manufactured Home Remodel

Manufactured Mobile Home Insurance 2022 Guide Nerdwallet

Clayton Homes Everything You Should Know Before Buy Mhc

Financing Mobile Manufactured Homes Fha Usda Programs

9 Mobile Home Improvement Ideas That You Can Do Mobile Home Makeovers Mobile Home Improvements Remodeling Mobile Homes

Fha Manufactured Home Loan Guidelines Requirements 2022